Amaya Reports Third Quarter 2016 Results; Updates Full Year 2016 Guidance

MONTREAL, Canada, November 14, 2016 – Amaya Inc. (NASDAQ: AYA; TSX: AYA) today reported financial results for the third quarter ended September 30, 2016, updated its previously announced guidance ranges for the full year 2016, and provided certain additional updates. Unless otherwise noted, all dollar ($) amounts are in U.S. dollars.

“As we have concluded the strategic review process, we are excited to continue focusing on improving the company and our operations. We continued to execute on our four strategic priorities during the quarter as evidenced by our strong performance,” said Rafi Ashkenazi, Chief Executive Officer of Amaya. “I am particularly pleased with our core poker business as we believe the proactive changes we made to our poker ecosystem have both substantially offset and began to reverse certain negative trends facing that business. We plan to continue leveraging this positive momentum into our casino and sportsbook offerings as we focus on becoming the world’s favorite online gaming destination and maximizing winning moments for all of our customers.”

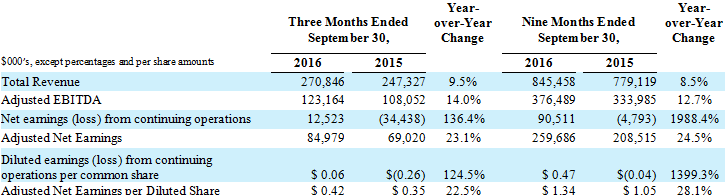

Third Quarter and Year-to-Date Financial Summary(1)

(1) For important information on Amaya’s non-IFRS measures, see below under “Non-IFRS and

Non-U.S. GAAP Measures” and the tables under “Reconciliation of Non-IFRS Measures to Nearest IFRS

Measures”. As a result of Amaya’s change in presentation currency from Canadian dollars to U.S. dollars

during the first quarter of 2016, the comparative and historical figures disclosed herein and in Amaya’s

financial statements and management’s discussion and analysis for the three and nine months ended

September 30, 2016 have been retrospectively adjusted to reflect such change as if the U.S. dollar had

been used as the presentation currency for all prior periods presented.

Third Quarter 2016 Financial Highlights

- Revenues - Total revenues for the quarter increased approximately 9.5% year-over-year. Excluding the impact of year-over-year changes in foreign exchange rates, total revenues for the quarter would have increased by approximately 11.7%. Real-money online poker revenues and real-money online casino and sportsbook combined revenues represented approximately 73% and 24% of total revenues for the quarter, respectively, as compared to approximately 81% and 15% for the prior year period.

- Poker Revenues – Real-money online poker revenues for the quarter were $196.8 million, or a decrease of approximately 1.3% year-over-year, evidencing the continued positive impact of Amaya’s previously announced strategy of focusing on recreational players, including through changes to its online poker loyalty program and rake structure, certain adjustments to Amaya’s multi-table tournament payout structure, and the introduction of new poker promotions. This positive impact offset an approximately 7.8% year-over-year decline in July alone following the 2016 Euros tournament and the cessation of operations in a few smaller jurisdictions.

- Debt – Total long term debt outstanding at the end of the quarter was $2.56 billion with a weighted average interest rate of 5.1%.

Third Quarter 2016 Operational Highlights

- Quarterly Real-Money Active Uniques (QAUs) – Total combined QAUs were approximately 2.4 million, an increase of approximately 5% year-over-year. Approximately 2.3 million of such QAUs played online poker during the quarter, an increase of approximately 3% year-over-year, while Amaya’s online casino offerings had approximately 486,000 QAUs, an increase of approximately 40% year-over-year, which Amaya estimates is one of the largest casino player bases among its competitors. Amaya’s emerging online sportsbook offerings had approximately 232,000 QAUs, a significant increase year-over-year.

- Quarterly Net Yield (QNY) – Total QNY was $111, an increase of 4.2% year-over-year. Excluding the impact of year-over-year changes in foreign exchange rates, total QNY was $114, an increase of 7.0% year-over-year. QNY is a non-IFRS measure.

- Customer Registrations – Customer Registrations increased by 1.9 million to approximately 105.5 million at the end of the quarter.

- Operational Excellence Initiatives – As part of Amaya’s strategy and as previously reported, it continues to review its expense structure and identify areas for improvement that it believes will enhance shareholder value. This has included certain office and departmental restructurings, including in London, Sydney and Dublin. Where possible, Amaya has been reassigning staff within the organization and does not currently expect a significant net reduction in headcount by the end of 2016. Amaya continues to assess and monitor the overall impact of these initiatives on its operations and performance.

2016 Full Year Guidance

Amaya has updated its 2016 full year guidance ranges, as previously announced on October 18, 2016, and currently expects the following:

- Revenues of $1,137 to $1,157 million;

- Adjusted EBITDA of $500 to $510 million;

- Adjusted Net Earnings of $344 to $354 million; and

- Adjusted Net Earnings per Diluted Share of $1.78 to $1.83.

These estimates reflect management’s view of current and future market conditions, including assumptions of no (i) material adverse regulatory events or (ii) material foreign currency exchange rate fluctuations that could negatively impact customer purchasing power as it relates to Amaya’s U.S. dollar denominated product offerings.

Rational Group Deferred Payment

Amaya intends to prepay approximately $200 million of the $400 million deferred purchase price for its acquisition of the Rational Group in August 2014 on or about November 18, 2016, subject to market, business and other conditions and considerations. To make such payment, Amaya will use approximately $143 million of its required monthly excess cash flow deposits and approximately $57 million of unrestricted cash on its balance sheet. Such prepayment will be at a 6% annual discount rate and Amaya expects to save approximately $2.5 million by making the prepayment. The balance of the deferred purchase price is due on February 1, 2017. As previously reported, Amaya is pursuing various non-dilutive options to pay the balance of such deferred purchase price and expects to announce the same by the end of the current fiscal year.

Financial Statements, Management’s Discussion and Analysis and Additional Information

Amaya’s unaudited condensed consolidated financial statements and management’s discussion and analysis for the three and nine months ended September 30, 2016, as well as additional information relating to Amaya and its business, can be found on SEDAR at www.sedar.com, Edgar at www.sec.gov and Amaya’s website at www.amaya.com.

In addition to press releases, securities filings and public conference calls and webcasts, Amaya intends to use its investor relations page on its website as a means of disclosing material information to its investors and others and for complying with its disclosure obligations under applicable securities laws. Accordingly, investors and others should monitor the website in addition to following Amaya’s press releases, securities filings and public conference calls and webcasts. This list may be updated from time to time.

Conference Call and Webcast

Amaya will host a conference call today, November 14, 2016 at 8:30 a.m. ET to discuss its financial results for the third quarter and year-to-date 2016 and related matters. Rafi Ashkenazi, Chief Executive Officer of Amaya, will chair the call. To access via tele-conference, please dial +1 877-407-0789 or +1 201-689-8562 ten minutes prior to the scheduled start of the call. The playback will be made available two hours after the event at +1 844-512-2921 or +1 412-317-6671. The Conference ID number is 13649792. To access the webcast please use the following link: http://public.viavid.com/index.php?id=121913

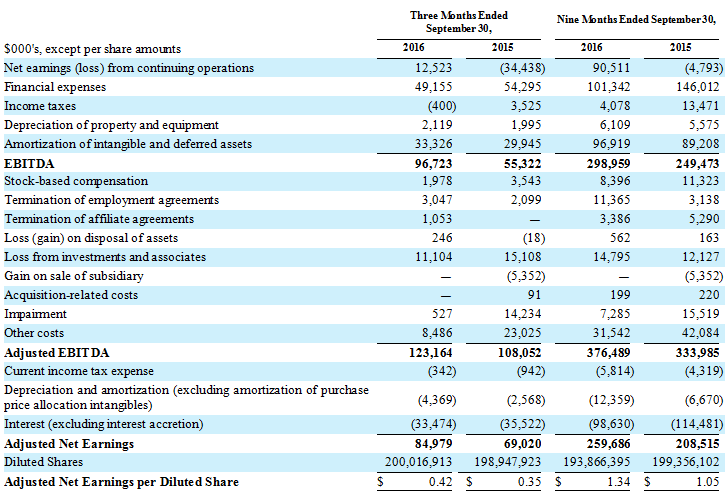

Reconciliation of Non-IFRS Measures to Nearest IFRS Measures

The table below presents reconciliations of Adjusted EBITDA, Adjusted Net Earnings and Adjusted Net Earnings per Diluted Share to the nearest IFRS measures:

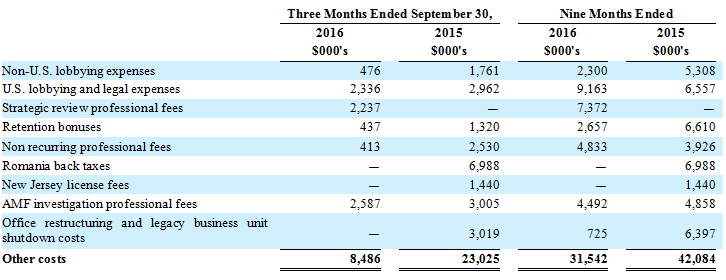

The table below presents certain items comprising “Other costs” in the reconciliation table above:

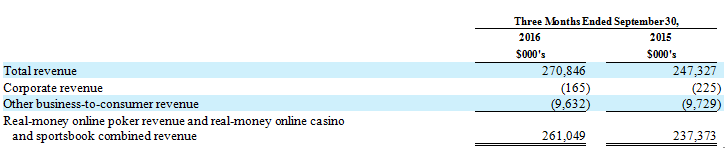

The table below presents a reconciliation of the numerator of QNY (i.e., real-money online poker revenue and real-money online casino and sportsbook combined revenue) to the nearest IFRS measure (i.e., total revenue) as reported for the applicable period. Unless otherwise noted, any deviation in the reconciliation below to measures presented herein may be the result of immaterial adjustments made in later periods due to certain accounting reallocations.

Amaya has not provided a reconciliation of the non-IFRS measures to the nearest IFRS measures included in its full year 2016 financial guidance provided in this release, including Adjusted EBITDA, Adjusted Net Earnings and Adjusted Net Earnings per Diluted Share, because certain reconciling items necessary to accurately project such IFRS measures, particularly net earnings (loss) from continuing operations, cannot be reasonably projected due to a number of factors, including variability from potential foreign exchange fluctuations impacting financial expenses, and the nature of other non-recurring or one-time costs (which are excluded from non-IFRS measures but included in net earnings (loss) from continuing operations).

For additional information on Amaya’s non-IFRS measures, see below and its Management’s Discussion and Analysis for the three and nine months ended September 30, 2016 (the “Q3 2016 MD&A”), including under the headings “Management’s Discussion and Analysis” and “Selected Financial Information—Other Financial Information”.

About Amaya

Amaya is a leading provider of technology-based products and services in the global gaming and interactive entertainment industries. Amaya ultimately owns gaming and related consumer businesses and brands including PokerStars, Full Tilt, BetStars, StarsDraft, PokerStars Casino and the PokerStars Championship and PokerStars Festival live poker tour brands (incorporating the European Poker Tour, PokerStars Caribbean Adventure, Latin American Poker Tour and the Asia Pacific Poker Tour). These brands have more than 105 million cumulative registered customers globally and collectively form the largest poker business in the world, comprising online poker games and tournaments, live poker competitions, branded poker rooms in popular casinos in major cities around the world, and poker programming created for television and online audiences. Amaya, through certain of these brands, also offers non-poker gaming products, including casino, sportsbook and daily fantasy sports. Amaya, through certain of its subsidiaries, is licensed or approved to offer, or offers under third party licenses or approvals, its products and services in various jurisdictions throughout the world, including in Europe, both within and outside of the European Union, the Americas and elsewhere. In particular, PokerStars is the world’s most licensed online gaming brand, holding licenses or related operating approvals in 16 jurisdictions.

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and applicable securities laws, including, without limitation, certain financial and operational expectations and projections, such as full year 2016 financial guidance and certain future operational plans and strategies, including, without limitation, as it relates to its operational excellence initiatives and the repayment of the deferred purchase price for the acquisition of the Rational Group and the financing of the same. Forward-looking statements can, but may not always, be identified by the use of words such as “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “would”, “should”, “believe”, “objective”, “ongoing” and similar references to future periods or the negatives of these words and expressions. These statements, other than statements of historical fact, are based on management’s current expectations and are subject to a number of risks, uncertainties, and assumptions, including market and economic conditions, business prospects or opportunities, future plans and strategies, projections, technological developments, anticipated events and trends and regulatory changes that affect us, our customers and our industries. Although Amaya and management believe the expectations reflected in such forward-looking statements are reasonable and are based on reasonable assumptions and estimates, there can be no assurance that these assumptions or estimates are accurate or that any of these expectations will prove accurate. Forward-looking statements are inherently subject to significant business, regulatory, economic and competitive risks, uncertainties and contingencies that could cause actual events to differ materially from those expressed or implied in such statements. Specific risks and uncertainties include, but are not limited to: the heavily regulated industry in which Amaya carries on business; interactive entertainment and online and mobile gaming generally; current and future laws or regulations and new interpretations of existing laws or regulations with respect to online and mobile gaming; potential changes to the gaming regulatory scheme; legal and regulatory requirements; ability to obtain, maintain and comply with all applicable and required licenses, permits and certifications to distribute and market its products and services, including difficulties or delays in the same; significant barriers to entry; competition and the competitive environment within Amaya’s addressable markets and industries; impact of inability to complete future acquisitions or to integrate businesses successfully; ability to develop and enhance existing products and services and new commercially viable products and services; ability to mitigate foreign exchange and currency risks; ability to mitigate tax risks and adverse tax consequences, including, without limitation, the imposition of new or additional taxes, such as value-added and point of consumption taxes, and gaming duties; risks of foreign operations generally; protection of proprietary technology and intellectual property rights; ability to recruit and retain management and other qualified personnel, including key technical, sales and marketing personnel; defects in Amaya’s products or services; losses due to fraudulent activities; management of growth; contract awards; potential financial opportunities in addressable markets and with respect to individual contracts; ability of technology infrastructure to meet applicable demand; systems, networks, telecommunications or service disruptions or failures or cyber-attacks; regulations and laws that may be adopted with respect to the Internet and electronic commerce and that may otherwise impact Amaya in the jurisdictions where it is currently doing business or intends to do business; ability to obtain additional financing on reasonable terms or at all; refinancing risks; customer and operator preferences and changes in the economy; dependency on customers’ acceptance of its products and services; consolidation within the gaming industry; litigation costs and outcomes; expansion within existing and into new markets; relationships with vendors and distributors; and natural events. Other applicable risks and uncertainties include those identified under the heading “Risk Factors and Uncertainties” in Amaya’s Annual Information Form for the year ended December 31, 2015 and “Risk Factors and Uncertainties” and “Limitations of Key Metrics and Other Data” in its Q3 2016 MD&A, each available on SEDAR at www.sedar.com, EDGAR at www.sec.gov and Amaya’s website at www.amaya.com, and in other filings that Amaya has made and may make with applicable securities authorities in the future. Investors are cautioned not to put undue reliance on forward-looking statements. Any forward-looking statement speaks only as of the date hereof, and Amaya undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

Non-IFRS and Non-U.S. GAAP Measures

This news release references non-IFRS and non-U.S. GAAP financial measures, including QNY, Adjusted EBITDA, Adjusted Net Earnings, Adjusted Net Earnings per Diluted Share, and the foreign exchange impact on revenues (i.e., constant currency). Amaya believes these non-IFRS and non-U.S. GAAP financial measures will provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating Amaya, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS or U.S. GAAP. They are not recognized measures under IFRS or U.S. GAAP and do not have standardized meanings prescribed by IFRS or U.S. GAAP. These measures may be different from non-IFRS and non-U.S. GAAP financial measures used by other companies, limiting its usefulness for comparison purposes. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on Amaya’s operating results. In addition to QNY, which is defined below under “Key Metrics and Other Data”, Amaya uses the following non-IFRS and non-U.S. GAAP measures in this release:

Adjusted EBITDA means net earnings (loss) from continuing operations before interest and financing costs (net of interest income), income taxes, depreciation and amortization, stock-based compensation, restructuring and certain other items.

Adjusted Net Earnings means net earnings (loss) from continuing operations before interest accretion, amortization of intangible assets resulting from purchase price allocation following acquisitions, deferred income taxes, stock-based compensation, restructuring, foreign exchange, and certain other items. Adjusted Net Earnings per Diluted Share means Adjusted Net Earnings divided by Diluted Shares. Diluted Shares means the weighted average number of common shares on a fully diluted basis, including options, warrants and Amaya’s convertible preferred shares. The effects of anti-dilutive potential common shares are ignored in calculating Diluted Shares. See note 8 to Amaya’s unaudited interim condensed consolidated financial statements for the three and nine months ended September 30, 2016. As of September 30, 2016 and for the purposes of the full year 2016 guidance provided in this release, Diluted Shares equals 193,866,395.

To calculate revenue on a constant currency basis, Amaya translated revenue for the three and nine months ended September 30, 2016 using the prior year's monthly exchange rates for its local currencies other than the U.S. dollar, which Amaya believes is a useful metric that facilitates comparison to its historical performance.

For additional information on Amaya’s non-IFRS measures, see the Q3 2016 MD&A, including under the headings “Management’s Discussion and Analysis” and “Selected Financial Information—Other Financial Information”.

Key Metrics and Other Data

Amaya defines QAUs as active unique customers (online, mobile and desktop client) who generated rake, placed a bet or otherwise wagered (excluding free play, bonuses or other promotions) on or through an Amaya poker, casino or sportsbook offering during the applicable quarterly period. Amaya defines unique as a customer who played at least once on one of Amaya’s real-money offerings during the period, and excludes duplicate counting, even if that customer is active across multiple verticals (e.g., both poker and casino). Beginning with its second quarter 2016 results, Amaya no longer provides PokerStars-only QAUs as a result of the recently completed migration of the Full Tilt brand and customers to the PokerStars platform.

Amaya defines QNY as combined real-money online gaming and related revenue (excluding certain other revenues, such as revenues from play-money offerings, live events and branded poker rooms) for its two business lines (i.e., real-money online poker and real-money online casino and sportsbook) as reported during the applicable quarterly period (or as adjusted to the extent any accounting reallocations are made in later periods) divided by the total QAUs during the same period. Amaya provides QNY on a U.S. dollar and constant currency basis. QNY is a non-IFRS measure.

Amaya defines Customer Registrations as the cumulative number of real-money and play-money customer registrations on PokerStars and Full Tilt.

For additional information on Amaya’s key metrics and other data, see the Q3 2016 MD&A, including under the headings “Limitations on Key Metrics and Other Data” and “Key Metrics”.

For investor relations, please contact:

Tim Foran

Tel: +1.416.545.1325

For media inquiries, please contact:

Eric Hollreiser